“Very organized company and client centric! Delivers great results.”

– VARSITY BRANDS

OUR APPROACH

The largest tax firm in the country whose sole practice

is property tax.

97% client retention rating

NPS rating of 82

4.6 Google star reviews

Transparency in The Property Tax Process

The property tax process often lacks transparency, leading to confusion and mistrust among taxpayers when working with third party consultants.

This lack of transparency can result in taxpayers questioning the accuracy of their tax bills and feeling powerless to understand or challenge them effectively. Furthermore, without a transparent process, errors or discrepancies may go unnoticed, potentially leading to incorrect tax assessments and unfair financial burdens on property owners.

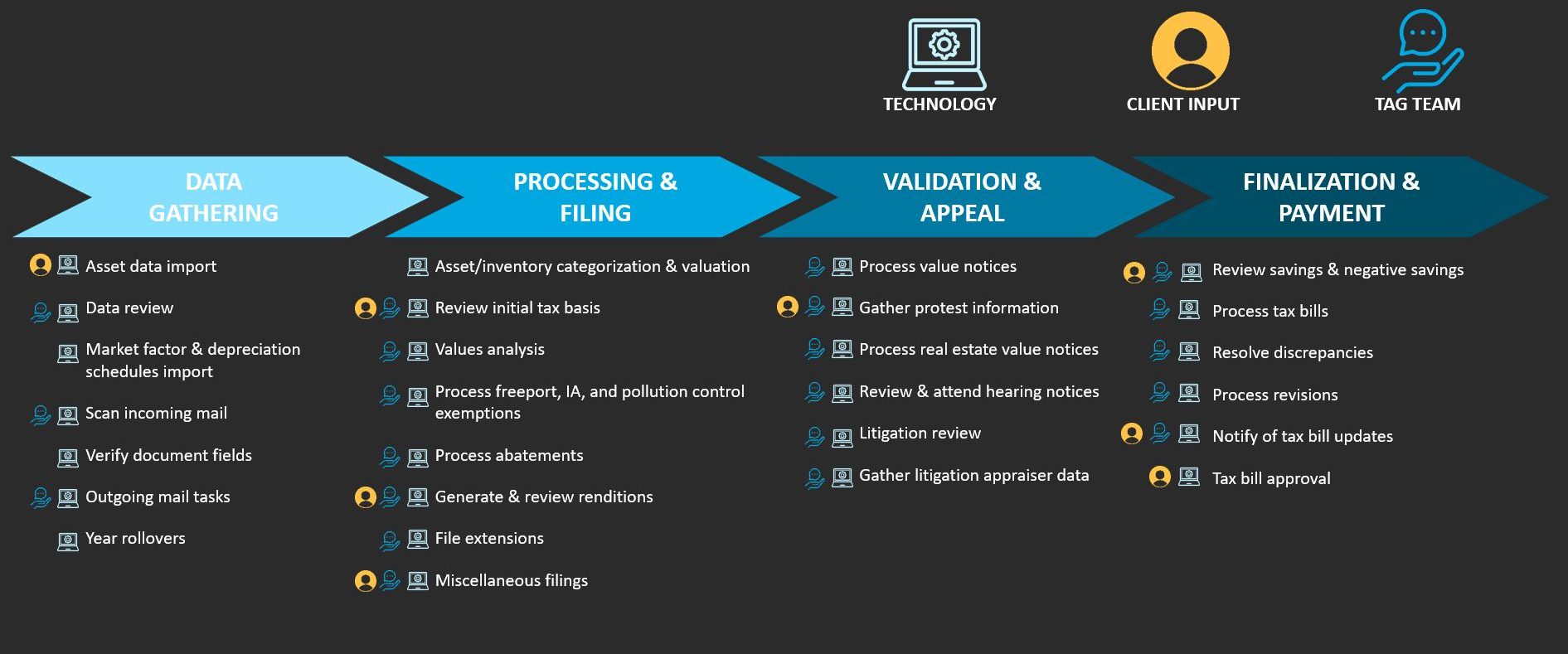

To address these concerns, TAG’s experienced consultants follow a comprehensive approach to property tax management that leverages our property tax management software to prioritize transparency, create predictability, and consolidate all aspects of our property tax process to closely collaborate with our clientele. Partner with us to gain a clear understanding of how your taxes are managed, calculated, and allocated for maximum property tax optimization.

The highly detailed data gathering process for property taxes involves meticulously collecting and analyzing a vast array of property-related information to ensure accuracy and transparency in tax assessment and collection.

A detailed approach to processing and filing property taxes entailing thorough examination and meticulous handling of all relevant documents and information to ensure accuracy and compliance with tax regulations.

A high-level approach to the execution of the validation and appeal process involving rigorous scrutiny and expert adjudication to gather protest information, ensure fairness and accuracy in addressing taxpayer concerns and grievances, and litigation reviews as needed.

The finalization and payment process of property tax bills entails a comprehensive review of the bill, potential process revisions, and timely settlement to ensure adherence to regulations and facilitate efficient tax collection.

Working together to achieve results.

A single, trackable process to empower your team with greater visibility into the entire tax process.

OUR APPROACH

The largest tax firm in the country whose sole practice is property tax.

97% client retention rating

NPS rating of 85

4.6 Google star reviews

Transparency in The Property Tax Process

The property tax process often lacks transparency, leading to confusion and mistrust among taxpayers when working with third party consultants.

This lack of transparency can result in taxpayers questioning the accuracy of their tax bills and feeling powerless to understand or challenge them effectively. Furthermore, without a transparent process, errors or discrepancies may go unnoticed, potentially leading to incorrect tax assessments and unfair financial burdens on property owners.

To address these concerns, TAG’s experienced consultants follow a comprehensive approach to property tax management that leverages our property tax management software to prioritize transparency, create predictability, and consolidate all aspects of our property tax process to closely collaborate with our clientele. Partner with us to gain a clear understanding of how your taxes are managed, calculated, and allocated for maximum property tax optimization.

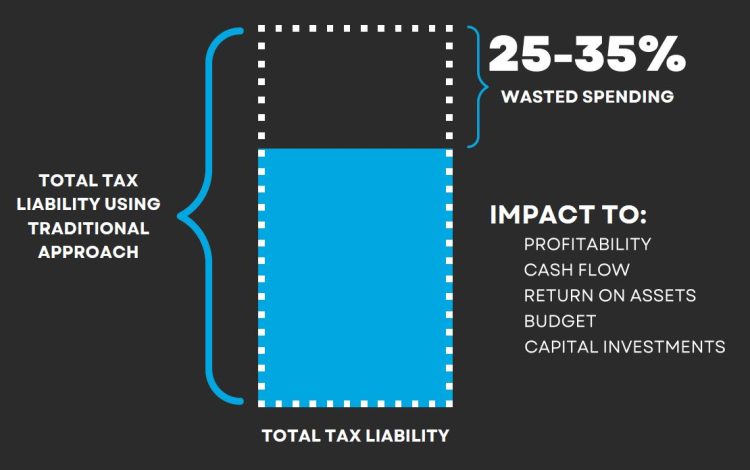

Overassessment of business personal and real property costs companies millions every year in unnecessary taxation.

Having dedicated expertise of the property tax laws in every state can greatly reduce overassessments, late penalties, and accounting errors.

In state’s where fair market renderings are available, significant savings can be realized for both business personal and real property to drive down taxes and free up capital.

Working closely with a firm solely dedicated to property taxes can provide the peace of mind needed to mitigate risk and eliminate wasted spending.

Overassessment of business personal and real property costs companies millions every year in unnecessary taxation.

Having dedicated expertise of the property tax laws in every state can greatly reduce overassessments, late penalties, and accounting errors.

In state’s where fair market renderings are available, significant savings can be realized for both business personal and real property to drive down taxes and free up capital.

Working closely with a firm solely dedicated to property taxes can provide the peace of mind needed to mitigate risk and eliminate wasted spending.

Deep analyses of your property taxes are conducted and consistently monitored to uncover and address wasted spending related to business personal and real property – helping you keep more of your hard-earned profits.

Because we have a singular focus on property taxes, our expertise in the space allows us to free up capital typically lost to over assessments, missed deadlines, and accounting errors. Our clients then use this capital to improve profitability or grow their businesses.

All tax work is performed by on-shore licensed property tax consultants and concierge-style support personnel with years of experience in multi-state BPP and commercial real estate tax statutes, rules and regulations.

Our tech-enabled platform provides any-time access to the work conducted around properties, built-in reporting, deadline alerts, and accrual tracking; with the end goal of helping you mitigate your tax exposure and better predict future costs associated with property taxes.

“Very organized company and client centric! Delivers great results.”

– VARSITY BRANDS

“We have been working with the Tax Advisors Group (TAG) for 5 years now. They are the “best in the business” in all matters relating to our Texas personal property taxes. I would highly recommend their services to anyone looking for a highly skilled, professional and reliable company.”

– ARAMARK

“TAG has saved our company a significant amount of tax dollars over the past several years while also being extremely responsive in helping with various administrative issues.”

– RYDER

“TAG has always managed our valuation appeals timely and with good results. We’ve enjoyed many years of successful reductions thanks to TAG.”

– MURPHY USA

“We’ve worked with TAG since 2018 and are pleased with the service the consultants have provided during our contract. Their information requests are submitted early with clear and concise details. We receive periodic updates throughout the filing season and beyond. I especially appreciate their review of the property tax bills and knowing once I’ve received them they are correct and ready to be paid.”

– CORNING

“Efficient and painless with a steady realization of savings. Great people to work with!”

– PUMA

We’re ready to help. Book a free property tax analysis.

Deep analyses of your property taxes are conducted and consistently monitored to uncover and address wasted spending related to business personal and real property – helping you keep more of your hard-earned profits. To date, we have saved our clients over $1 billion in undue taxation.

Because we have a singular focus on property taxes, our expertise in the space allows us to free up capital typically lost to over assessments, missed deadlines, and accounting errors. Our clients then use this capital to improve profitability or grow their businesses.

All tax work is performed by on-shore licensed property tax consultants and concierge-style support personnel with years of experience in multi-state BPP and commercial real estate tax statutes, rules and regulations.

Our tech-enabled platform provides any-time access to the work conducted around properties, built-in reporting, deadline alerts, and accrual tracking; with the end goal of helping you mitigate your tax exposure and better predict future costs associated with property taxes.

We’re ready to help. Book a strategy call today.